PCI DSS Certification Cost 2025: Factors, Estimates & Proven Ways to Cut Costs

If you process, store, or transmit cardholder data, you’ve probably Googled pci dss certification cost at least once. Good news: you’re in the right place. This guide breaks down what PCI DSS is, what “certification” actually means, realistic cost ranges for different company sizes, and smart ways to bring those numbers down without cutting breaching security.

What is PCI DSS “certification”?

PCI DSS (Payment Card Industry Data Security Standard) is a global baseline for protecting card data. It has 12 core requirements (from securing networks to monitoring access and testing regularly).

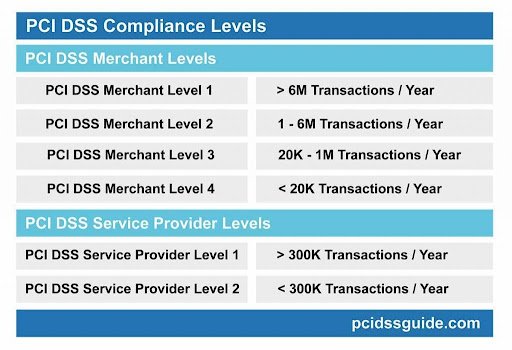

There isn’t a single, universal “certificate” issued by the PCI Council. Instead, your path depends on how many transactions you process and your risk profile:

- Lower-volume merchants/service providers typically complete a Self-Assessment Questionnaire (SAQ) + ASV quarterly scans.

- Higher-volume or higher-risk organizations must undergo a full assessment by a Qualified Security Assessor (QSA), producing a Report on Compliance (ROC) and an Attestation of Compliance (AOC). Many people refer to this as “PCI certification.”

What drives PCI DSS certification cost?

Think of PCI costs as a combination of scope + readiness + assurance level:

- Scope: How much of your environment touches card data? The more systems in scope, the more controls to implement and validate.

- Readiness: Are you close to being compliant or starting from scratch? Gaps (like missing logging, MFA, segmentation) add remediation costs.

- Assurance level: SAQ vs. QSA-led ROC. A QSA audit is more expensive but may be required based on volume/brand rules.

- People and partners: Internal team capacity, consultants, MSSPs, and vendors (WAFs, tokenization, SIEM).

- Geography and timing: QSA day rates, availability, and the new PCI DSS v4.0 requirements can affect pricing.

PCI DSS certification cost: realistic ranges

These are industry-informed estimates to help you budget. Your actual cost will depend on scope and readiness.

1) Small merchants (SAQ route)

- ASV quarterly scans: $200–$1,500 per year (depending on IPs/hosts).

- Vulnerability management tooling: $1,000–$10,000 per year (varies widely).

- External pen test (if your SAQ category requires it): $5,000–$15,000 annually.

- Consulting/help with SAQ (optional): $2,000–$10,000 one-time.

- Staff time: Equivalent of 0.1–0.25 FTE for policy updates, evidence, and scan management.

Typical first-year total: $5,000–$35,000

Ongoing annual: $3,000–$20,000

2) Mid-sized merchants or SaaS (may require ROC)

- QSA-led ROC assessment: $30,000–$100,000 (scope and complexity drive this).

- Penetration testing (external + internal + segmentation): $10,000–$40,000 annually.

- ASV scans: $500–$3,000 per year.

- SIEM/logging/MFA/WAF tools (if not already in place): $10,000–$100,000+ annually.

- Remediation (hardening, segmentation, tokenization): $10,000–$200,000+ one-time depending on gaps.

- Staff time: Project manager + security engineer (often 0.5–1.5 FTE combined during year one).

Typical first-year total: $75,000–$350,000+

Ongoing annual: $50,000–$200,000+

3) Large enterprises / service providers (ROC is standard)

- QSA-led ROC: $100,000–$400,000+

- Comprehensive pen testing program: $50,000–$250,000+ per year

- ASV scans: $2,000–$10,000+ per year (big external footprint)

- Security platforms (SIEM, EDR, WAF, micro-segmentation, key management): $250,000–$2M+ annually

- Remediation & architecture: $250,000–$3M+ (often multi-year)

- Staff: Dedicated compliance + security teams (3–10+ FTE touching PCI)

Typical first-year total: $600,000–$5M+

Ongoing annual: $400,000–$3M+

Simple estimate formula

Use this to sanity-check early budgets:

Estimated Year-1 PCI cost = Assessment + (Remediation × Scope Factor) + (Tooling × Maturity Factor) + People Time

- Scope Factor rises with the number of systems handling card data.

- Maturity Factor reflects how many security capabilities you already operate well (logging, MFA, change control, etc.).

Example budgets

Example A: Small e-commerce store (SAQ A-EP)

- Uses a hosted checkout + some card data passes through their environment.

- ASV scans: $800/year

- Pen test: $8,000

- Consultant for SAQ + evidence: $3,500

- Tooling upgrades (WAF/CDN plan bump): $2,400/year

- Internal time: 0.1 FTE ($7,000 loaded cost)

Year-1 total: ~$21,700; Annual ongoing: $12,000–$18,000

Example B: Mid-sized SaaS (ROC required)

- Multi-tenant app, stores tokens (not PAN), but handles auth and data flows.

- QSA ROC: $60,000

- Pen tests (app+infra+segmentation): $30,000

- SIEM onboarding + log storage: $45,000

- Remediation (segmentation + hardening): $75,000

- Internal time: 1 FTE for 6 months (~$50,000 loaded)

Year-1 total: ~$260,000; Annual ongoing: $150,000–$220,000

Example C: Global service provider (multiple data centers)

- QSA ROC: $250,000

- Pen testing program: $180,000

- Security platforms: $1.2M

- Remediation (micro-segmentation + key mgmt): $1.5M

- Internal team: 6 FTE (partial allocation ~$480,000)

Year-1 total: ~$3.61M; Annual ongoing: $1.8M–$2.6M

Hidden costs organizations forget

- Scope creep: A stray server processing logs with PAN can expand scope massively.

- Evidence wrangling: Collecting screenshots, configs, change tickets, and reports takes real time.

- Third-party dependencies: If a vendor becomes in-scope, you may need their AOC or additional controls.

- Change management: New features can invalidate controls if not designed with PCI in mind.

- Training and culture: Staff awareness reduces incidents and audit friction.

How to reduce your PCI DSS certification cost (without reducing security)

- Minimize scope with tokenization

Replace PANs with tokens via your payment gateway. Fewer systems touching card data = fewer controls to validate. - Use out-of-scope architectures

Hosted fields/redirects/iFrames and validated P2PE solutions keep your environment out of the most sensitive flows. - Segment like a pro

Strong network segmentation limits your Cardholder Data Environment (CDE). This is often the highest-ROI move. - Leverage existing platforms

Many cloud providers and modern SaaS tools offer PCI-friendly controls (MFA, logging, KMS) that reduce custom build time. - Get a readiness (gap) assessment before the ROC

Fix gaps first; your formal assessment will be faster, cheaper, and less painful. - Automate evidence collection

Use ticketing, IaC baselines, and centralized logging to generate audit-ready artifacts on demand. - Standardize your SDLC security

Built-in SAST/DAST, dependency checks, and change control reduce recurring pen-test findings. - Choose the right SAQ

Make sure your payment method qualifies you for the simplest SAQ type you legitimately can use.

Is PCI DSS compliance worth the investment?

Yes it is, when you compare it to the financial and reputational impact of a card data breach. Beyond fines and forensics, breaches often bring chargebacks, legal exposure, customer churn, and operational disruption. Many organizations also see improved security hygiene (better logging, access control, and patching) that reduces risk beyond payments.

Frequently asked questions about pci dss certification cost

Do we need a QSA audit to be “certified”?

Not always. Lower-volume merchants can often use SAQ + ASV scans. Your acquirer or the card brands determine if a ROC by a QSA is required.

What’s the cheapest path to PCI compliance?

Use a fully hosted payment page/redirect, tokenize everything, and keep your systems out of scope. This can push you into an easier SAQ and avoid a ROC.

How long does it take?

For SAQ merchants, a few weeks if you’re ready. For ROC-level organizations, 1–4 months is common for the assessment phase after remediation.

What about PCI DSS v4.0?

It modernizes requirements (e.g., stronger authentication and ongoing testing). If you’re upgrading from older practices, budget additional remediation time and cost.

Can we reuse vendor AOCs?

service provider AOCs (e.g., your payment gateway or hosting provider) can reduce your scope, but you must configure and operate controls correctly in your environment.

Conclusion

PCI DSS certification cost varies with your transaction volume, environment scope, and security maturity. Small SAQ merchants typically spend $5k–$35k in year one, mid-sized firms needing a ROC budget $75k–$350k+, and large service providers can exceed $600k–$5M+. The biggest cost levers are scope (how many systems touch card data), remediation needs (segmentation, MFA, logging), and assessment type (SAQ vs. QSA-led ROC). To control PCI DSS certification cost, minimize scope with tokenization/hosted payments, segment aggressively, fix gaps before the audit, and automate evidence collection, reducing spend while strengthening real security.

Lower your PCI DSS Certification Cost with smart automation, start compliance the easy way with Regulance AI.